+48 74326 02396

Cash-Out Refinance in Utah

Need extra funds for home improvements, debt consolidation, or major expenses in Utah? A cash-out refinance lets you tap into your home’s equity by replacing your current mortgage with a new one—plus cash in hand.

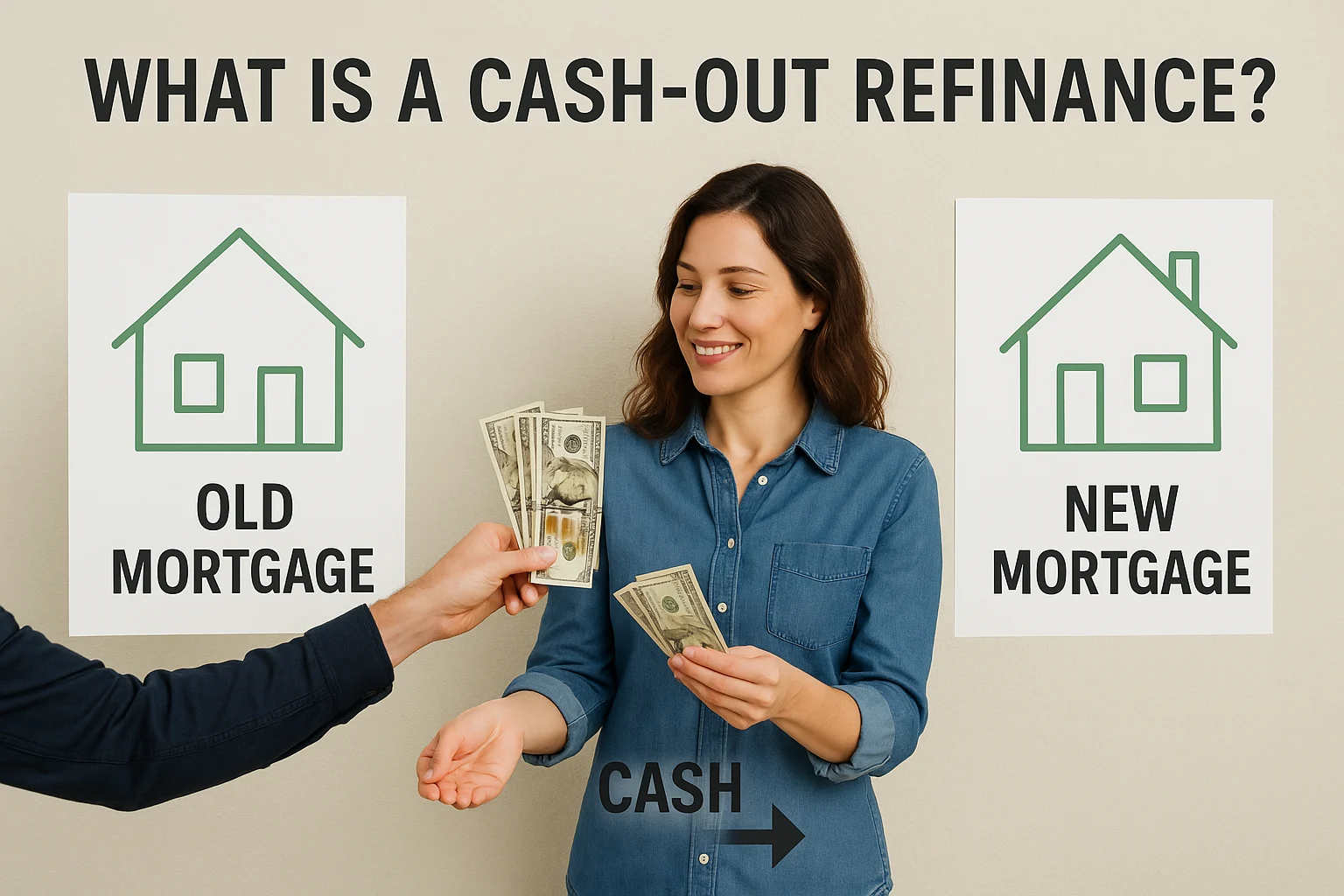

What is a cash-out refinance?

A cash-out refinance lets you replace your current mortgage with a new, larger loan, giving you the difference in cash. When you qualify, it can be a fast and accessible way to tap into your home’s equity to cover major expenses or reinvest in your property.

Whether you’re dealing with unexpected costs, legal fees, or planning a home upgrade, accessing your equity can be simple and efficient when you’re eligible.

How It Works:

- Your home’s current value is appraised

- You refinance into a new loan based on that value

- You receive the difference in cash

Top Reasons to Use a Cash-Out Refinance

Utah’s often use cash-out refis for elective procedures like fertility treatment, plastic surgery, or major medical bills

Navigating separation? A cash-out refi helps divide assets or cover attorney costs.

Pay off high-interest debt and simplify your monthly finances with one low-rate mortgage.

Want a new kitchen, deck, or solar system? Your equity can fund projects that increase your home’s value.

Compare vs. HELOC

| Feature | Cash-Out Refinance | HELOC |

|---|---|---|

| Fixed Interest Rate | ✅ | ❌ (variable) |

| Lump Sum Upfront | ✅ | ❌ (draw as needed) |

| Best for... | Major life events | Flexible/ongoing uses |

Success Stories from Utah Clients

Frequently Asked Questions

How long does it take to close?

Our current average turn time is approximately 24 days from application to funding.

Will it change my monthly payment?

Yes. Your new mortgage balance may be higher, but often at a lower rate than other forms of debt.

Can I get a cash-out loan if I own my house outright?

Yes. You can refinance a free-and-clear property to access up to 80% of its value.

Explore Other Loan Services

We offer more than just cash-out refinance options. Explore our full suite of lending solutions built for Utah homeowners and new residents alike:

Whether you’re tapping equity through cash-out refinance loans in Utah or starting fresh with a home relocation loan, our expert team is here to help.

Get Started Today

You’ve built equity. Now put it to work. We’ll help you review your options and lock in the best rate.